Project:

Stover's Residential

Care Facility

Stover’s Residential Care Facility at a Glance

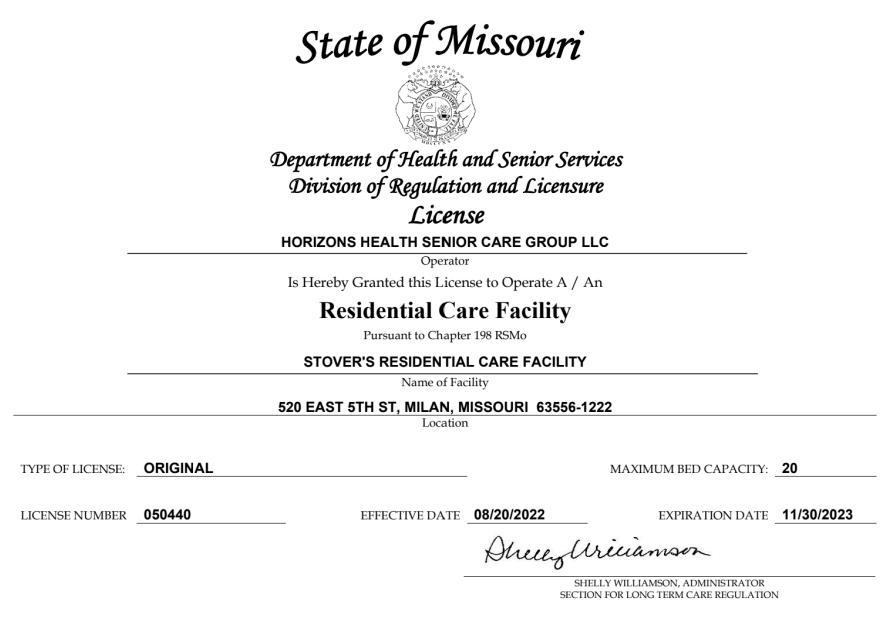

Stover’s Residential Care Facility was a modest 20-bed healthcare facility in northern Missouri with an aging physical plant and high-risk behavioral population when we acquired management. Despite its glaring issues, we saw a facility with untapped potential that could be tapped through refining operations. This timeline tells that story.

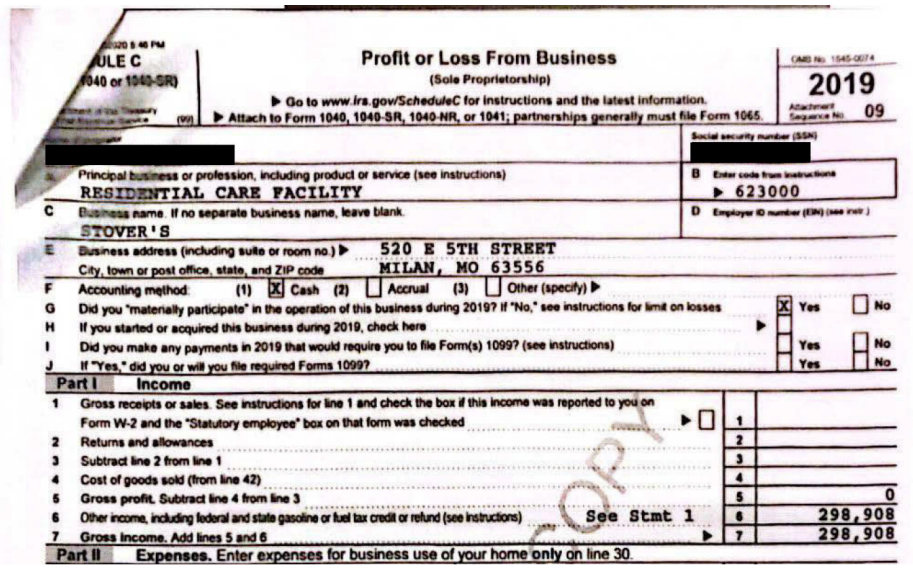

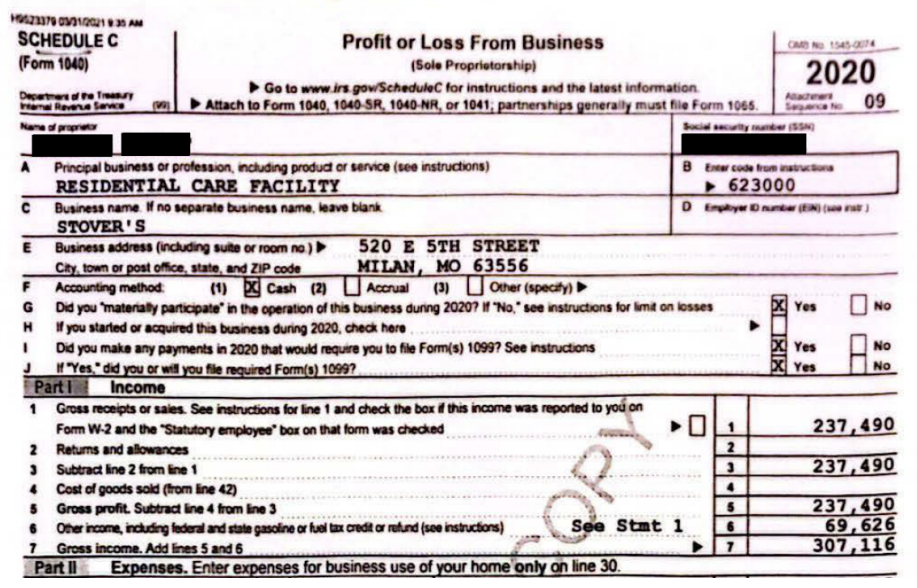

Top-line Progress

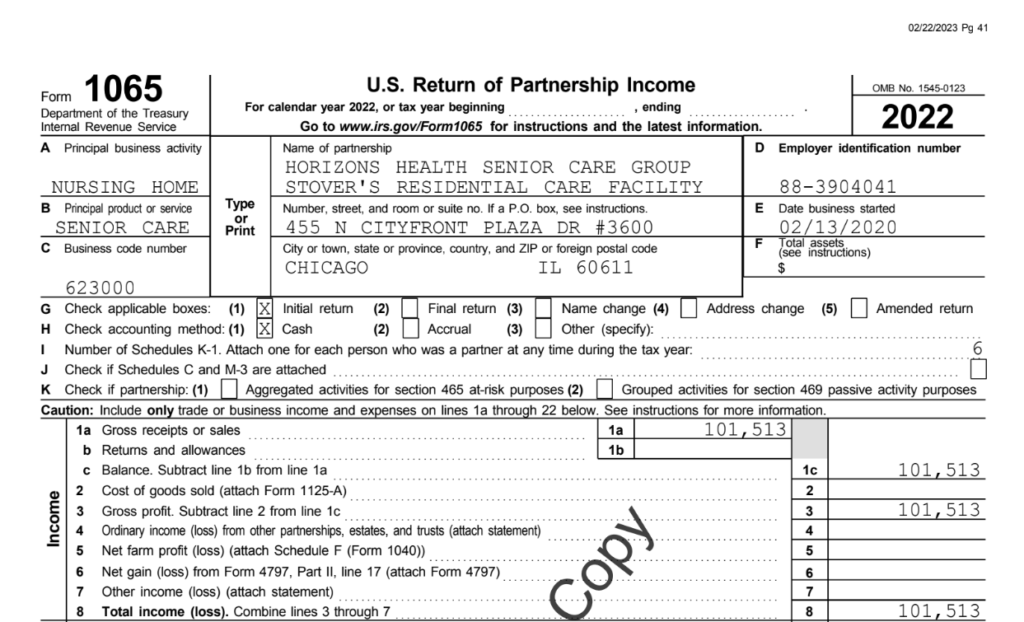

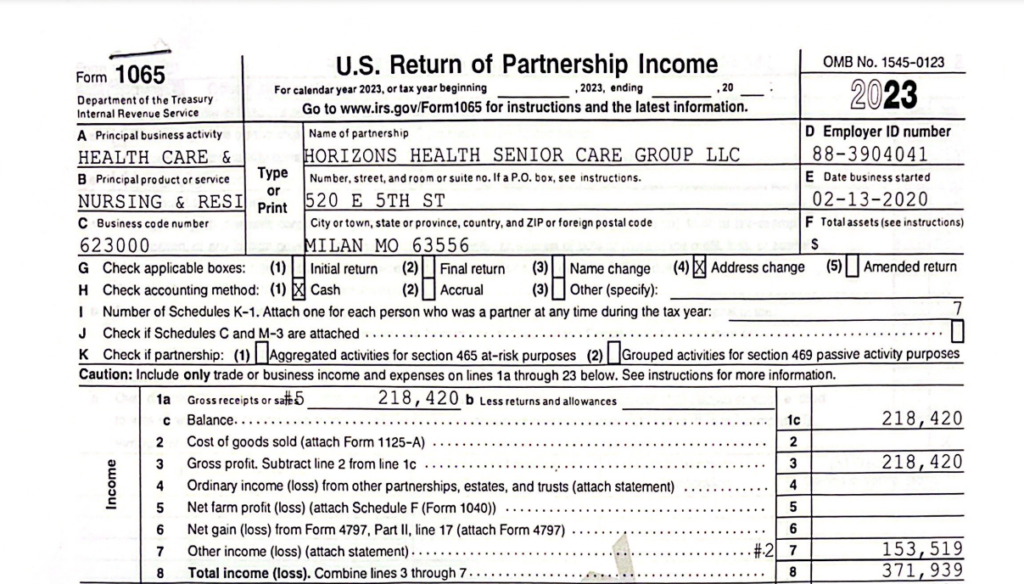

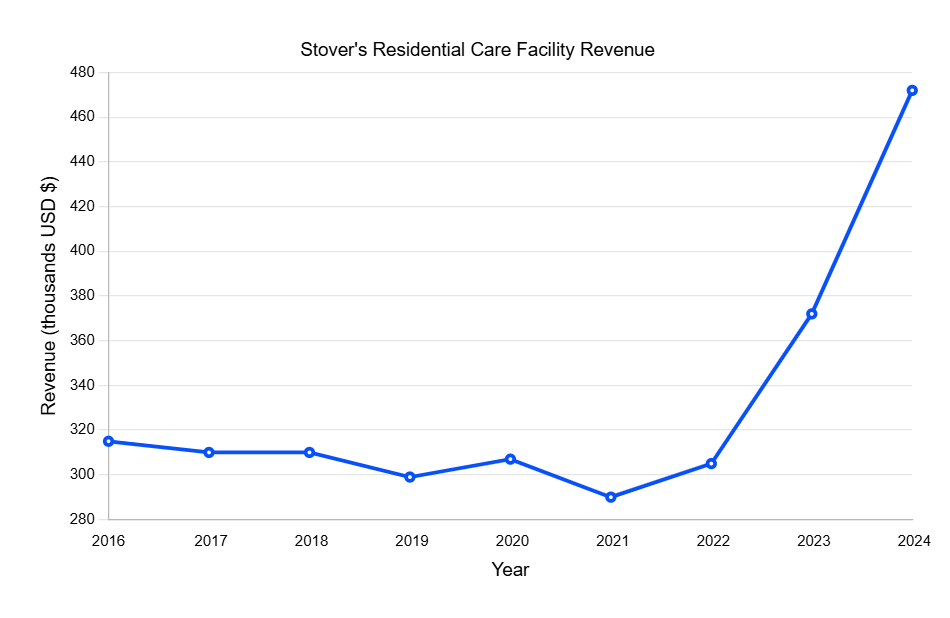

When we acquired management of Stover’s Residential Care Facility in mid-Q3 of 2022 from its sole proprietor, we aimed to achieve the highest value potential possible for a facility of its size. We focused our efforts on top-line revenue as the main theme of our turnaround, with a goal to hit an annual top-line of $380,000 in two years.

We planned to achieve this by leveraging Medicaid benefits for qualified residents while increasing the percentage of private-pay residents in the client population and building and maintaining occupancy.

We generated $371,939 of top-line revenue by the first calendar year's end.

We have omitted operational expenses and bottom-line profit here, focusing on revenue as the protagonist of our story.

Click This Link to View Financial Compilation

We generated $472,147.88 of top-line revenue by the second fiscal year's end.

Our Achievement

Operating Stover's

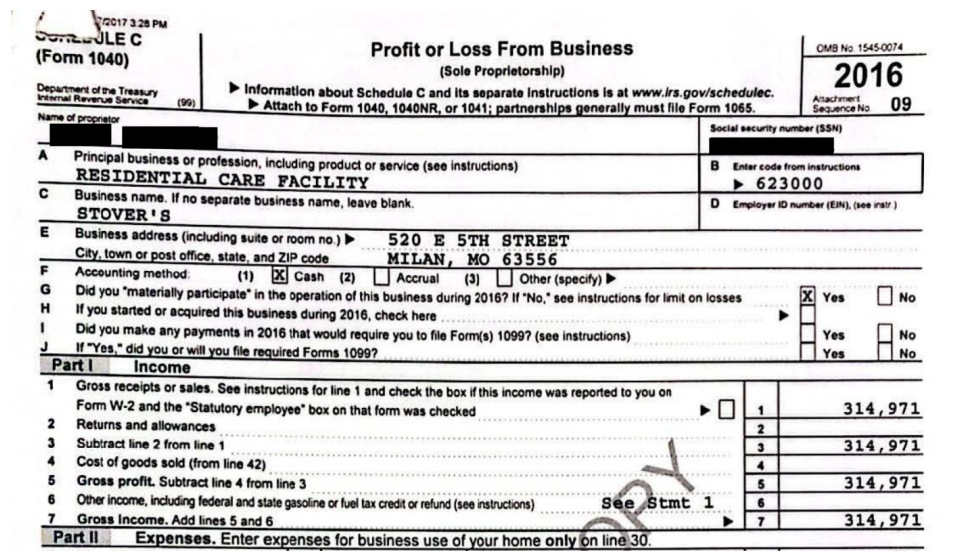

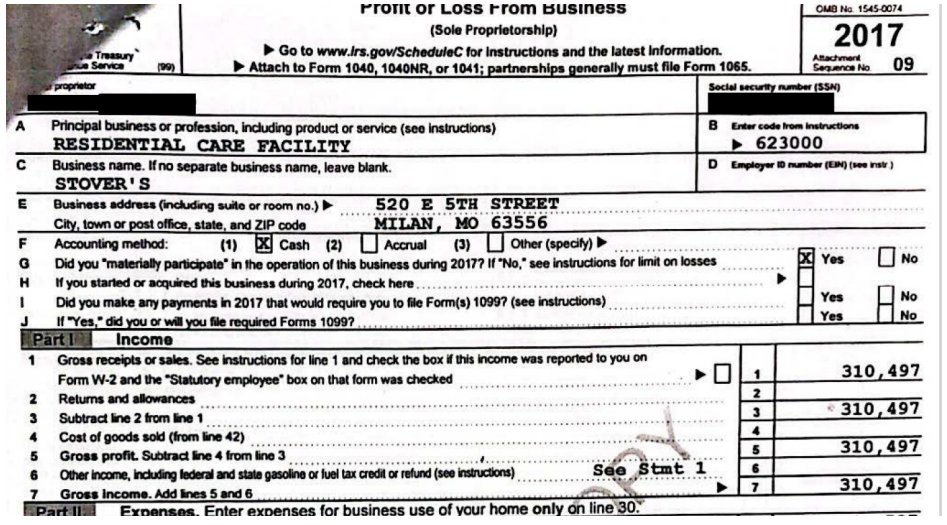

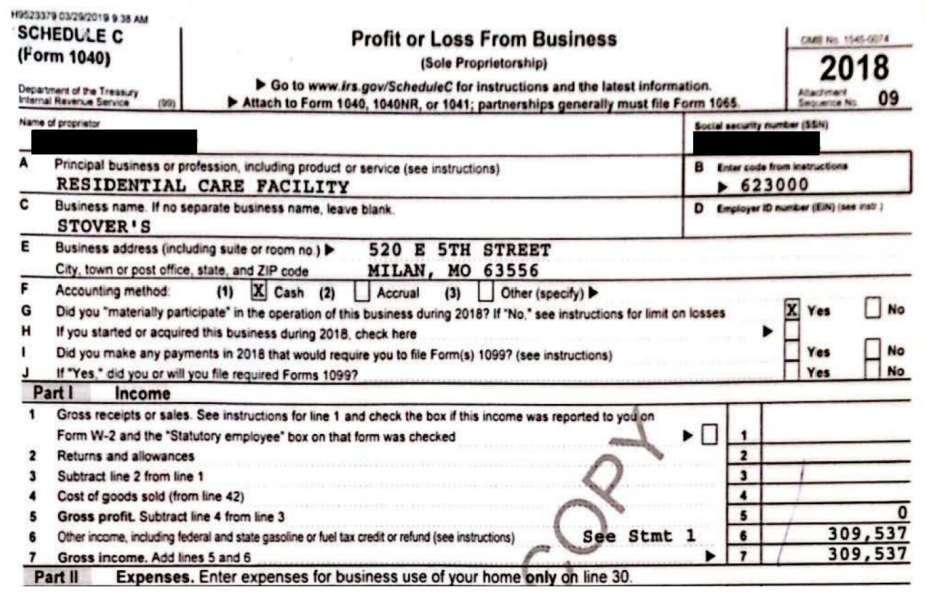

Upon acquisition, the facility’s former operator’s highest historical top-line was $314,971 in 2016. After our first full calendar year of operation, the facility’s top line reached $371,939 by Dec. 31, 2023, the highest recorded top line in its 50 years of operations. However, even this would be dwarfed by our performance in our second fiscal year of operations.

In the last full calendar year of management under the former operator (2021), the facility generated a top line of $290,222. During our second fiscal year operating the facility (Sept. 1, 2023 – Aug. 31, 2024), the facility’s top line reached $472,147.88: a whopping 63% increase in gross income, which squared the circle of our management strategy and added a successful notch to our belt.

To learn more about us please click the guided link to our Executive Summary.

Investments

Those looking to invest in future acquisitions should click the guided links to our Investment Tiers and example Investment Prospectus.

Correspondence regarding investment can be sent to jchambers@horizonshealthgroup.org.